days sales in inventory ratio interpretation

Two of the most widely used metrics to measure inventory efficiency are Inventory Turnover and Inventory-to-Sales Ratio or IS Ratio. Inventory to sales ratio measures the rate at which the company is liquidating its stocks.

Inventory Days Formula Meaning Example And Interpretation

Turned here means sold and replaced its inventory.

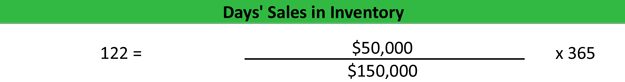

. The ratio measures the number of days it would take to clear the remaining inventory. Inventory value at the ending 60000. This indicates that Company As funds were blocked in inventories for almost 89 days.

This formula requires two variables. Days in Inventory formula is. High or rising inventory to sales ratio indicates that the company is incurring more storage and holding cost.

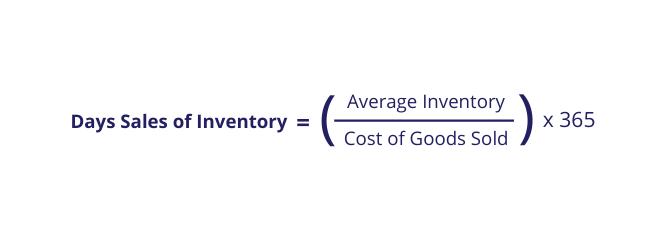

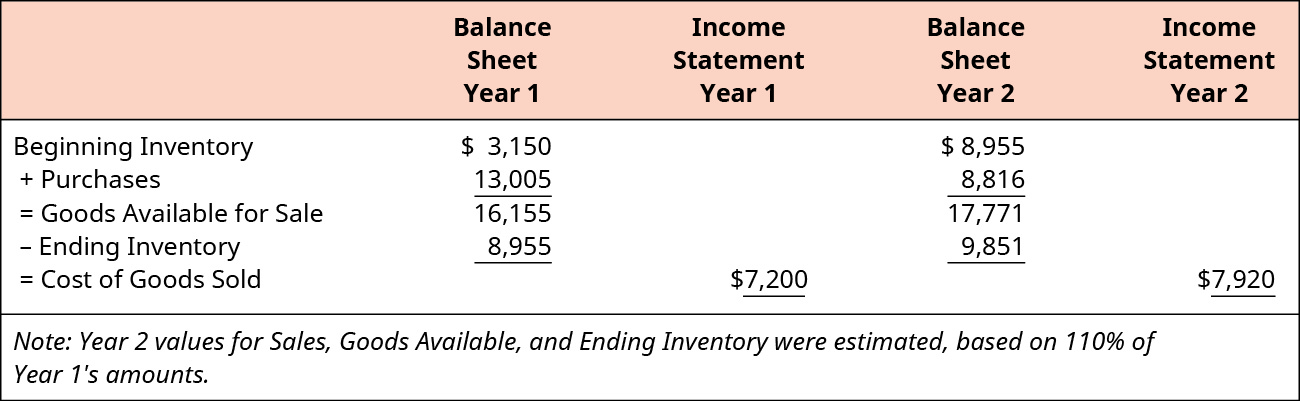

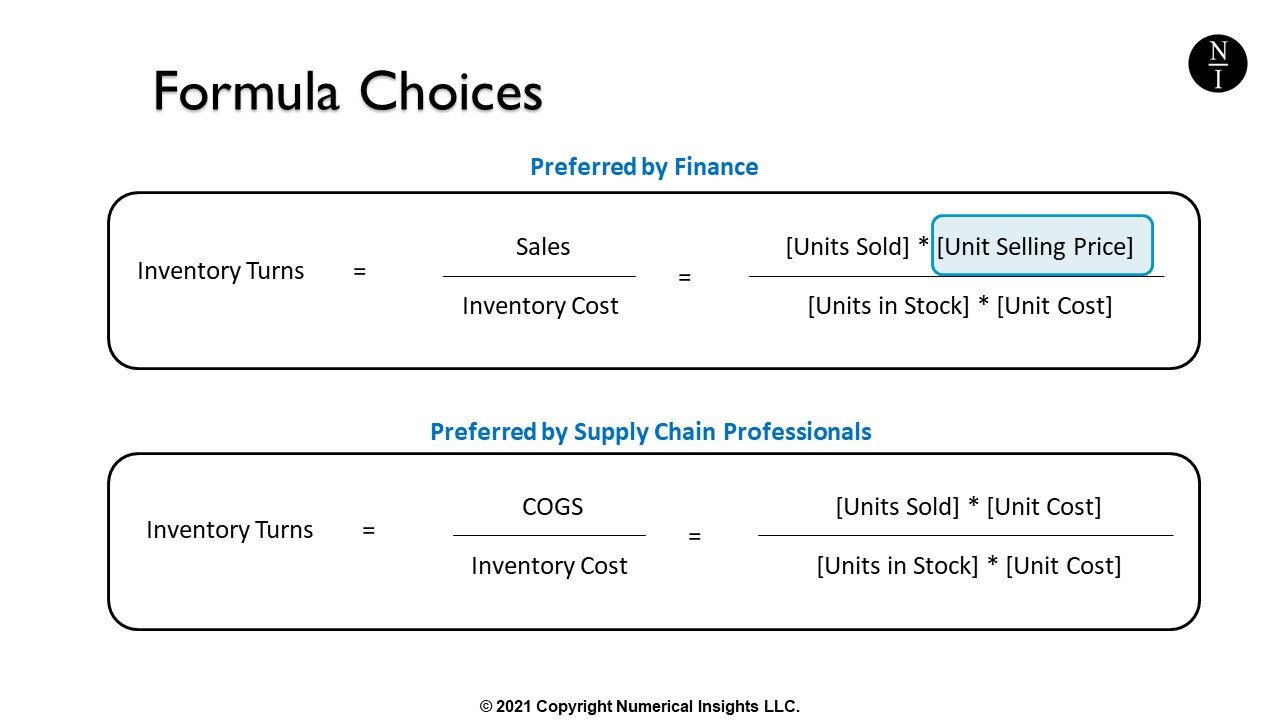

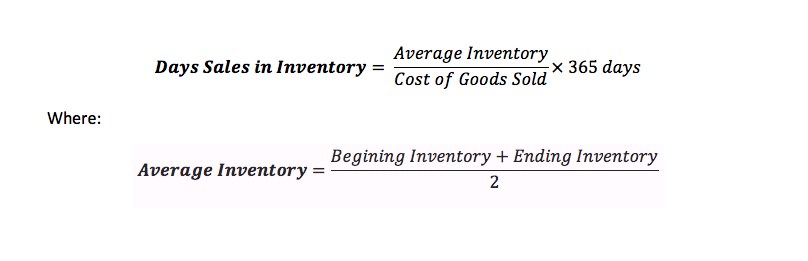

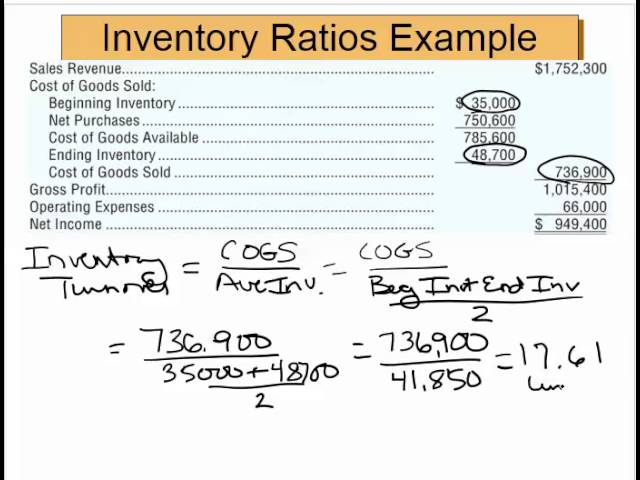

A Inventory Turnover Ratio Cost of Goods SoldAverage Inventory at Cost Average Inventory is calculated by adding the stock in the beginning and at the end of the period and dividing it by two. The ratio is calculated by dividing the cost of goods sold by the amount of average inventory at cost. Days inventory outstanding ratio explained as an indicator of inventory days sales in inventory turns is an importantfinancial ratiofor any company with inventory.

For that you need context. If so then inventory days is also related to the inventory turnover ratio. By employing the alternative formula we can confirm that the result of this calculation is correct.

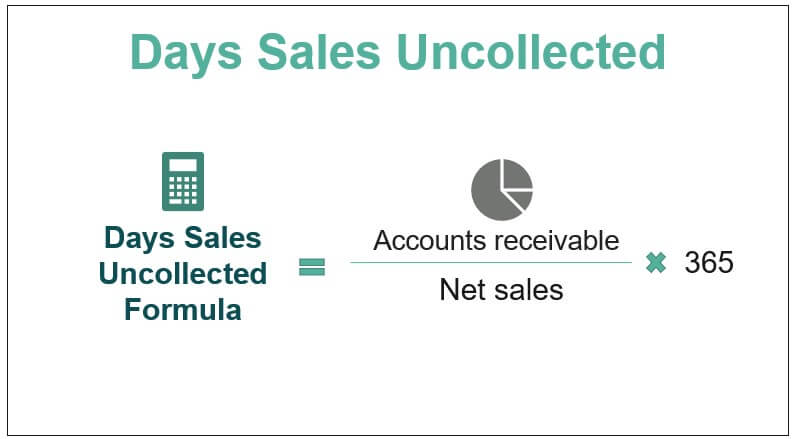

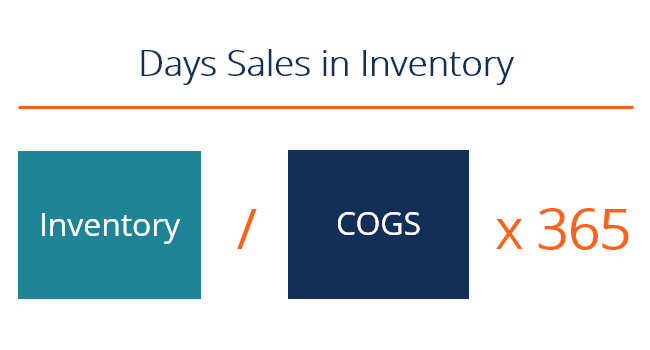

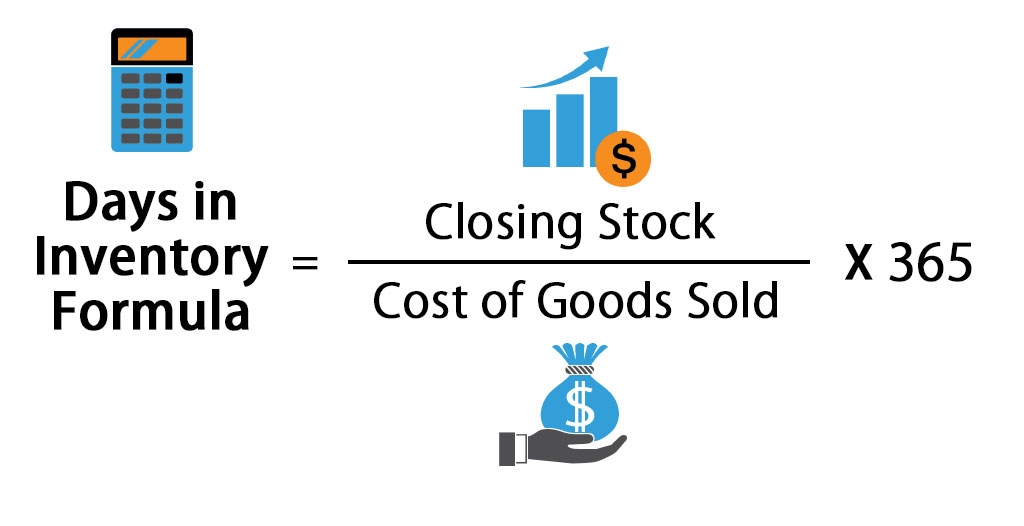

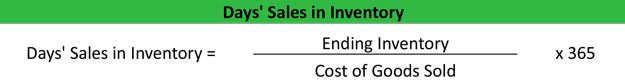

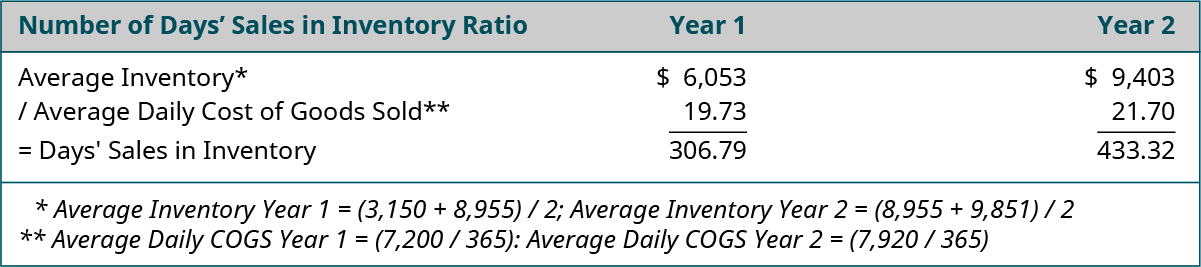

Days sales in inventory can also be called days inventory outstanding or the average age of an inventory. Calculating and Interpreting the Days Sales in Inventory Ratio Number of days sales in inventory ratio is computed by dividing average merchandise inventory by the average daily cost of goods sold. This calculation which is called Days Sales of Inventory or Days Inventory can estimate how long it takes to get a return on investment for inventory purchases.

DSI is calculated by taking the inverse of. Lets take a small example and look at how we can calculate this metric. Heres a sample 2019 Days Sales in Inventory calculation for each noting that Cost of Goods Sold for 2019 was 6208 million.

All inventories are a summation of finished goods work in progress and progress payments. Days in Inventory is frequently used together with Inventory Turnover Ratio. Days Sales in Inventory DSI sometimes known as inventory days or days in inventory is a measurement of the average number of days or time required for a business to convert its inventory Inventory Inventory is a current asset account found on the balance sheet consisting of all raw materials work-in-progress and finished goods that a into sales.

Interpreting Inventory Turnover Knowing your companys inventory turnover ratio wont necessarily help you understand how the business is performing. Average Inventory 50000 60000 2 55000 COGS 125000 x 1-045 68750 IT COGS Average Inventory 68750 55000 125 This means that the company has turned its inventory 125 times in a year. Inventory Turnover Days Average Inventory Cost of Goods Sold 360 Inventory Turnover Days 360 Inventory turnover Times Should be mentioned that the value of the inventory turnover days can fluctuate during the.

In the same 30 days they carried an average of 5000 units in inventory at a total cost of 25000. Definition of Inventory Days I assume that inventory days is referring to the days sales in inventory. Day of Sales in Inventory 183 2506666 1446000 105 days.

Days Sales in Raw Materials 365 121 6208 7 days. Days Sales in Work in Process 365 414 6208 24 days. Days Sales in Finished Goods 365 339 6208 20 days.

A high inventory turnover ratio implies either strong sales or ineffective buying the company buys too often in small quantities therefore the buying price is higherA high inventory turnover ratio can indicate better liquidity but it can also indicate a shortage or inadequate inventory levels which may lead to a loss in business. The days sales in inventory ratio also known as days stock outstanding or days in stock measures the amount of times it is going to take a business to market all its stock. It is the number of days or months in which the inventory is converted into sales to determine the cash conversion cycle Determine The Cash Conversion Cycle The Cash Conversion Cycle CCC is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash.

The Average number of days worth of sales that is held in inventory. Allen sold 5000 units generating 100000 in sales. In the sales figure.

Days in Inventory calculator measures the average number of days the company holds its inventory before selling it. Days sales of inventory DSI measures how many days it takes for inventory to turn into sales. Days of Sales in Inventory 1446000 2506666 183 105 days.

Days in Inventory calculator is part of the Online financial ratios calculators complements of our consulting team. It is an analytical tool used to gauge the operational efficiency of a business. Net sales and average inventory.

It includes material cost. In this post well be explaining IS Ratio. The days sales of inventory DSI is a financial ratio that indicates the average time in days that a company takes to turn its inventory including goods that are a.

Days Inventory Outstanding 40000 60000 2 365 300000 60 Days. Inventory value at the beginning 40000. Days Inventory Outstanding Average inventory Cost of sales x Number of days in period.

Days sales in inventory DSI refers to a financial ratio showing the number of days a company takes to turn over all its inventory. Days Inventory on hand Average Inventories COGS 365 Company A 123500 365 8979 days Company B 123800 365 5611 days What this means is that Company A takes around 89 days to sell all of its Inventory during a year. Lets review this using The Spy Who Loves You dataset.

Cost of goods sold 300000. Inventory days or average days in inventory is a ratio that shows the. For instance when the inventory turnover is low the days sales in inventory will be high.

Cost of Sales is also known as Costs of Goods Sold Cost of Goods Sold COGS Cost of Goods Sold COGS measures the direct cost incurred in the production of any goods or services. Related to Days sales in inventory ratio Trading and Investments Terms Ratio - The relation that one quantity bears to another of the same kind with respect to magnitude or numerical value. Days Inventory Outstanding Calculation with Example.

To put it differently the times sales in inventory ratio reveals the number of days per firms recent asset of stock will continue. In general a decrease in DIO is an improvement to working capital and an increase is deterioration. Average inventory Beginning inventory Ending inventory 2.

Inventory Turnover Ratio Formula And Tips For Improvement

Inventory Days Double Entry Bookkeeping

Inventory Days Formula How To Calculate Days Inventory Outstanding

Days Sales Outstanding Formula Meaning Example And Interpretation

Day S Sales Uncollected Formula Step By Step Calculation Examples

Days Sales Outstanding Dso Formula And Excel Calculator

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

Formula To Calculate Inventory Turns Inventory Turnover Rate

Days Sales In Inventory Ratio Analysis Formula Example

Inventory Days Formula Meaning Example And Interpretation

Days Sales Of Inventory Dsi Definition

Days Sales In Inventory Dsi Overview How To Calculate Importance

Days In Inventory Formula Calculator Excel Template

Inventory Turnover Ratio Formula Meaning Example And Interpretation

Days Inventory Outstanding Dio Formula And Excel Calculator

Days Sales In Inventory Ratio Analysis Formula Example

Days Sales In Inventory Definition Formula Calculated Example Analysis

Ineventory Turnover And Days Sales In Inventory Ratios Youtube

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting