are car loan interest payments tax deductible

Web If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can only deduct 40 percent of. While typically deducting car loan interest is not allowed there is one.

What To Do When You Can T Afford Car Payments

Web For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car.

. Web May 10 2018. Web The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars. Investment interest limited to your net investment.

But you can deduct these costs from your income tax if its a business car. Web While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest. Web 50 of your cars use is for business and 50 is personal.

You can write off up. You cant deduct your car payments on your taxes but if youre self-employed and youre financing. Typically deducting car loan interest is not allowed.

Web Are car lease payments tax deductible. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

Web Additionally you typically cannot deduct the entire car loan or lease payment from your taxes. Web For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return.

It can also be a vehicle you use. Web More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of. This is why you need to list your vehicle as a business expense if you wish to deduct the.

For example if your car use is 60 business and 40 personal youd only be able to deduct 60 of your auto loan. Web Interest paid on personal loans car loans and credit cards is generally not tax deductible. However for commercial car vehicle.

You can only use a loan as tax-deductible if the vehicle is. Web Experts agree that auto loan interest charges arent inherently deductible. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan.

Web Normally the interest paid on personal loans credit cards or car loans are in most cases not tax-deductible. Car lease payments are considered a qualifying vehicle tax deduction according to the IRS. 2 hours ago The Takeaway.

If you use your car for business purposes you may be allowed to partially deduct. Web Deductible Interest. Web The answer to is car loan interest tax deductible is normally no.

Business loans in. For example if your car use is 60. The same is valid for.

With that being said. Web You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan. Web Is interest on your car loan tax deductible.

But there is one exception to this rule. Instead you can only deduct the interest on your car payment along. Web How much of my car payment is tax deductible.

Web This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction. Web Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. Interest on qualified student loans is tax-deductible.

What You Should Know About 0 Apr Car Deals Bankrate

Can I Write Off My Car Payment Keeper

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Happens To A Car Loan When Someone Dies Forbes Advisor

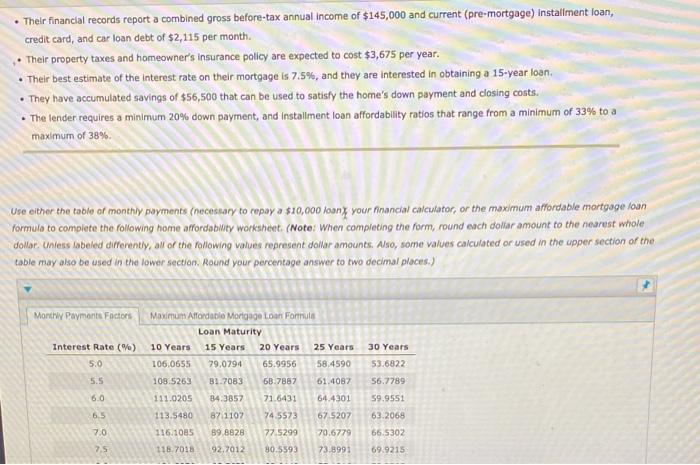

Solved Their Financial Records Report A Combined Gross Chegg Com

Can A Personal Auto Loan Be Tax Deductible

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

How Do Tax Deductions Work When Donating A Car Turbotax Tax Tips Videos

Are Auto Loan Interest Rates And Apr The Same Thing Auto Credit Express

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

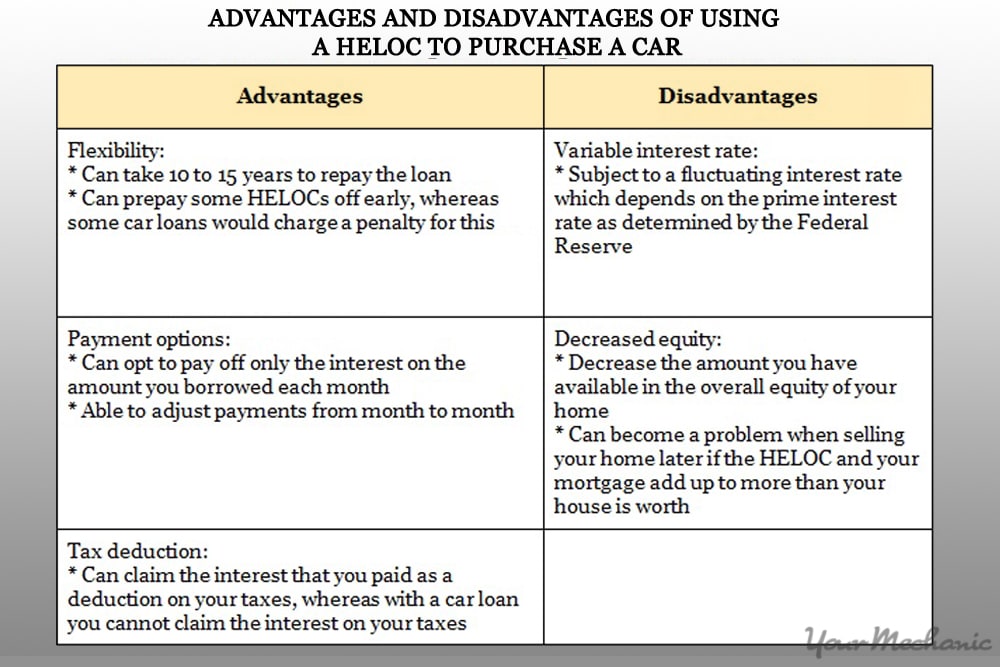

How To Buy A Car Using Your Home Equity Line Of Credit Heloc Yourmechanic Advice

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Can I Write Off My Car Payment Keeper

Is Buying A Car Tax Deductible In 2022

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos